Amongst all the changes you’ll notice on the field in 2023 -- the pitch clock, the positioning ban, the larger bases, the pickoff limits -- there’s another quietly meaningful one that might not be quite so obvious if you weren’t looking for it. For the first time since Interleague Play arrived in the Majors in 1997, the schedule will be balanced. Every team will play the other 29 teams at least once annually and also visit each city at least once every other year.

It’s meant to be fairer for the Wild Card race, and to prevent things like “five fanbases still haven’t ever seen Shohei Ohtani come to town,” as is currently the case. Long-term, it’s clearly going to fulfill those goals. But for 2023, there’s a more interesting question, particularly in the fact that teams will be playing 24 fewer games against their own divisions than they did before, and that question is, "How will this affect the playoff races?"

Think about the Phillies, who got to feast on the Nationals (16-3) as they won the final Wild Card slot by a single game. Think about the Guardians, who were a mere .500 against winning teams yet a massive 58-36 against losing teams on their way to winning the AL Central by 11 games. Think about the Orioles, Blue Jays and Rays, who for decades have had nearly a quarter of their schedule coming against just the Yankees and Red Sox. Who you play matters, and who you play in 2023 under the balanced schedule is going to be different than who you might have played before.

So: Who wins out here? Let’s run the numbers.

What we did was to take the 2023 schedule breakdown, as outlined here, and compared it to what the 2023 schedule would have been under the old rules, with more in-division play and less intraleague play. (Under that format, Interleague Play opponents rotated against the other league’s divisions one per year, so in 2023, it would have been NL East vs. AL Central, NL Central vs. AL West and NL West vs. AL East. That’s the what-would-have-been comparison we’ll use, not the 2022 schedule we just observed, as FanGraphs’s Dan Szymborski did in a good initial look last summer. If you really want to see the big ugly grid of what our schedule comparison looks like, check that out here.)

Knowing the difference between who teams would have played and instead now will be playing -- for example, the White Sox would have played their four AL Central rivals 19 times apiece and nothing at all against the NL West; now they play in the division 13 times apiece and pick up 15 games against the NL West -- it’s easy enough to take each team’s 2023 projected winning percentage from FanGraphs and whip up some strength of schedule numbers based on who, and how often, you’re going to play as opposed to what it would have been otherwise.

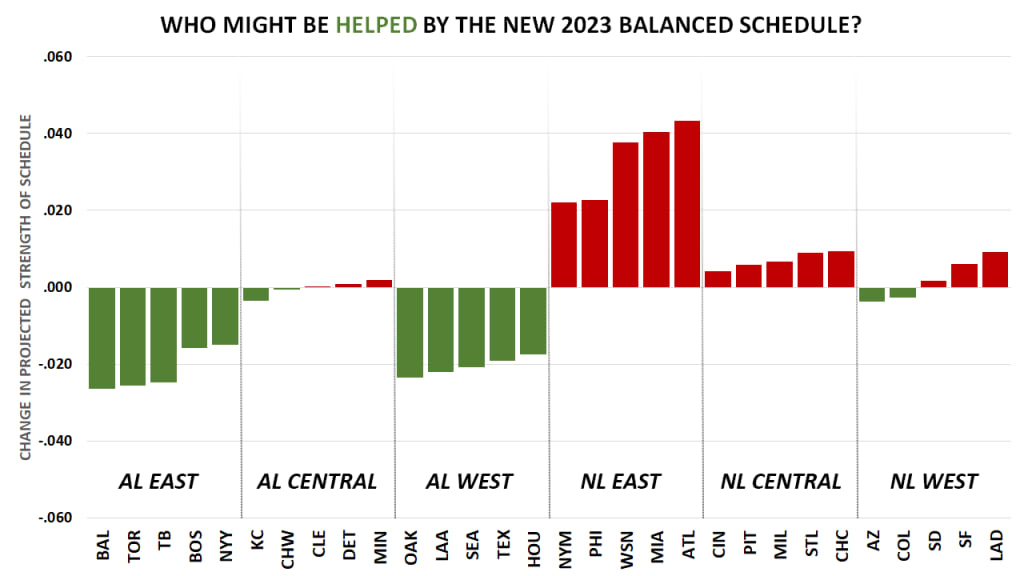

All of which gives us these outcomes …

It is, as you’d expect, not a massive amount. Plus, it relies largely on teams playing to projected performance, which we know won’t happen perfectly -- though there’s generally a pretty strong relationship between projected outcomes and actual outcomes. But it might help change the outcome of a game or two here and there, and that could be the difference between getting into the playoffs or going home.

AMERICAN LEAGUE

It’ll help: The entire AL East and the entire AL West

It won’t matter much for: The AL Central

It’ll hurt: No one, meaningfully

By this method, all 10 teams in the East and West will benefit to the tune of between .015 and .030 points of opponent strength of schedule. (The way to read that is like this: The Orioles would have had a .517 projected opponent strength of schedule, the hardest in the game. Now, they’ll have a .490 projected opponent strength of schedule, the ninth-easiest. That’s a +.027 boost for them.)

It makes all the sense in the world that the AL East teams would be pleased, because it’s baseball’s toughest division, and now they get to play less of one another. To illustrate that, take the Blue Jays, who get to slice off 24 games against the East. They were going to have to play four against the Braves either way, and would have already been scheduled against the NL West. But now, those 24 games that would have been against the beasts of the east now come against the weak NL Central and the four remaining NL East teams -- two of which aren’t much good anyway.

It’s the same in the AL West, which currently has four teams projected .500 or better. Take away 24 games against divisional rivals -- this is especially good for Oakland, which doesn’t get the benefit of playing itself -- and replace them with games against the NL West and NL East (which, again, is extremely top heavy), and see the benefit.

But for the relatively weak AL Central, it doesn’t seem like it’ll matter so much. That’s because these five teams had already been scheduled to face the NL East in 2023, so those games aren’t new, and instead they’ll pick up games against the equally weak NL Central and the NL West, which features a somewhat depleted (compared to previous years) Dodgers squad and the very poorly projected Rockies. We project these five teams with almost no change at all.

The takeaway: It was already pretty hard to see the Central sending a team to the Wild Card, given the strength in the East and West, and this only exacerbates that.

NATIONAL LEAGUE

It’ll help: No one, meaningfully

It won’t matter much for: The NL Central, the NL West

It’ll hurt: The NL East

Interestingly, the opposite, though perhaps that’s not so surprising because Interleague Play goes from 12% of a team’s schedule to 28%, and every win for one team is a loss for another; this all has to balance out somehow. The difference here is one of depth, because while both leagues are somewhat similar in that the Central is the weakest division, the AL might have five good teams in the East and four in the West, while the bottom halves of those divisions thin out more quickly in the NL.

(To that point, of the 11 teams projected by FanGraphs with the lowest projected winning percentage, seven are in the NL.)

The NL East plays out in interesting fashion. Take the Mets, for example. They would have played 66 games against the NL Central and West, and now they’re playing 64, so there’s very little difference there; same for the four games against their previously scheduled Interleague opponent, the Yankees. But instead of playing 76 games in their own division, it’s now only 52, and that’s somewhat a wash, because while they do get to avoid the strong Braves and Phillies more, they also lose the benefit of playing the weaker Marlins and Nationals as much -- a pair of teams that New York won 27 of 38 games against last season.

Those missing 26 games have to go somewhere. A dozen of them come against the AL East, where Baltimore, Boston, Tampa Bay and Toronto should all be competitive or better. Fifteen more come against the AL West, where four of the five clubs (all but Oakland) are projected to be .500 or better teams. That sounds harder.

In the NL Central, it’s almost identical to the AL Central. It’s not a strong division, and they were already going to play the AL West in 2023, so the trade in its in-division games for more games against the AL East (which is a bad thing) and AL Central (which is a good thing), and it’s almost something of a wash.

The difference in the leagues we see is in the NL West, which doesn’t benefit as much as the AL West might. That’s in part because it was already scheduled to face the difficult AL East this year, and so 24 of the in-division games will now be against -- and let’s quote ourselves here -- the AL West, which is better than you think, and the AL Central, which is relatively weak. If it seems like Arizona wins out here, it’s barely at all, so just a +.003 projected increase.

The takeaway: This might actually help the Wild Card contenders in the Central and West, who were rightfully staring at a Mets/Braves/Phillies trio and wondering if two of the three Wild Card spots would already be spoken for, regardless of who wins that division. The road out of the East just got slightly harder.